|

PROMPTS

|

YOUR INPUT

|

| LOG IN

|

If you need to void a sale you can do this by logging into your account on our web site. From there select the monthly statement that has the

transaction. In the transaction listing towards the top of the page, locate the item. Click on the date and the option to void the sale

is given. Only items that have not been processed yet can be voided. Future dated checks can be voided provided they are done prior to

their check dates.

In most cases the only time you'll need to void a sale is if the customer has changed their mind about making the purchase or if you discover there

was information the customer withheld indicating an inability to make the payments. A fasttrack request that is accepted as a standad G or V code should not be voided unless you are unable

to carry a 90 day term or believe the customer will default. The void function does not apply to fastrack since those were funded early.

|

|

Prompt

|

Your Response

|

A fax & e-mail from GCS alerting you to a return.

(retrieval request)

|

When an item is returned it becomes a claim and will be listed in the claims section of the merchant record. Each claim will have their status

listed and is updated in real time.

If a sale is not honored by your customer's bank respond to the retrieval request sent by GCS within the time limits given.

GCS also sends an e-mail to the customer who defaulted asking that they contact the store or us immediately.

|

|

Procedure

|

For G code items the limit to respond is generally 3 days but may be shorter if your account is less than 3 months old. An item may be charged back

if it doesn't meet the standard of the authorization given, if it's for an uncovered return reason, or the return rate is excessive.

Regardless the return reason all claims are pursued for recovery on an equal basis for your benefit.

For V code items they should be responded to as quickly as possible. V codes, although not guaranteed are treated the same as G codes for purposes of recovery and GC

makes the same effort to secure payment for the store.

If a customer who has a return wishes to pay the store directly the store must call us prior to accepting payment. Since GCS is attempting recovery it is likely a debit may already be

in process against the customer's account. To avoid customers being double charged GCS must be made aware of these situations before funds are accepted.

|

|

Standards

|

The following standards apply to maintain a G code status.

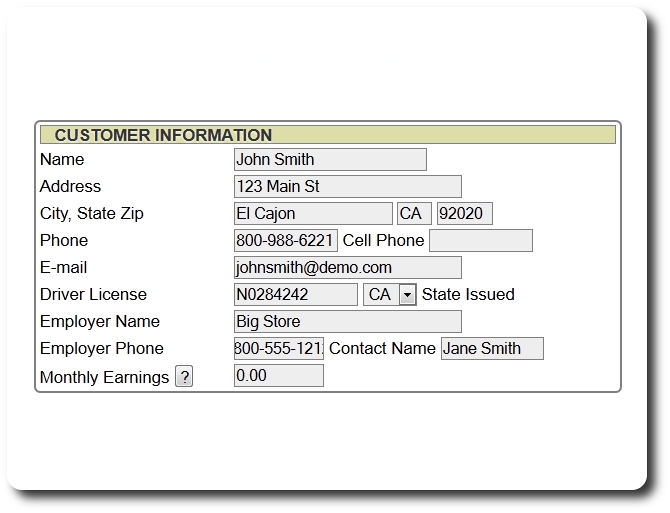

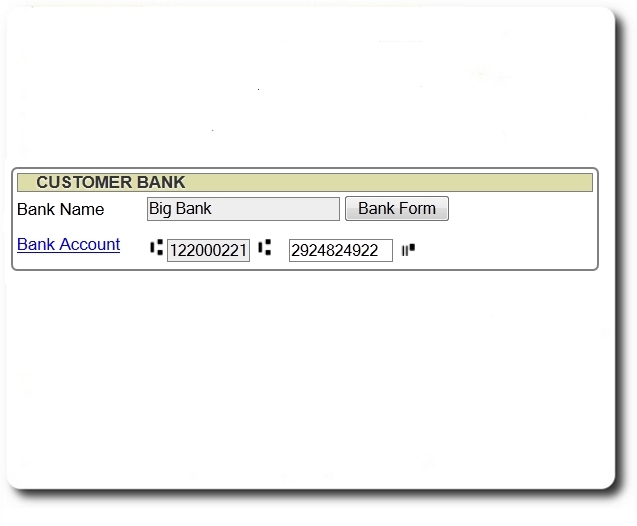

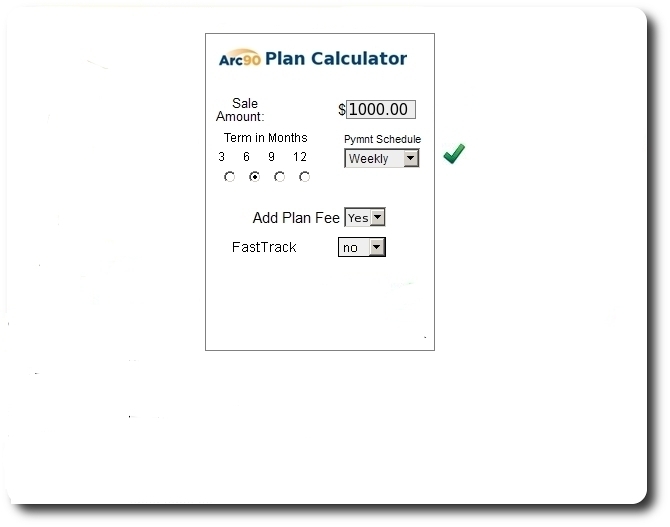

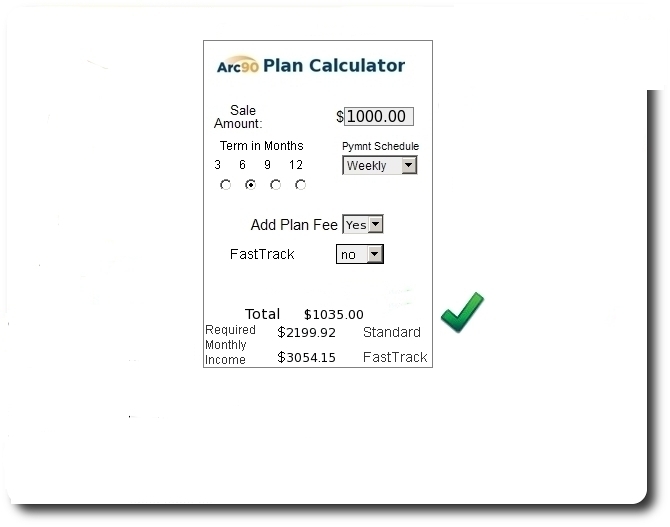

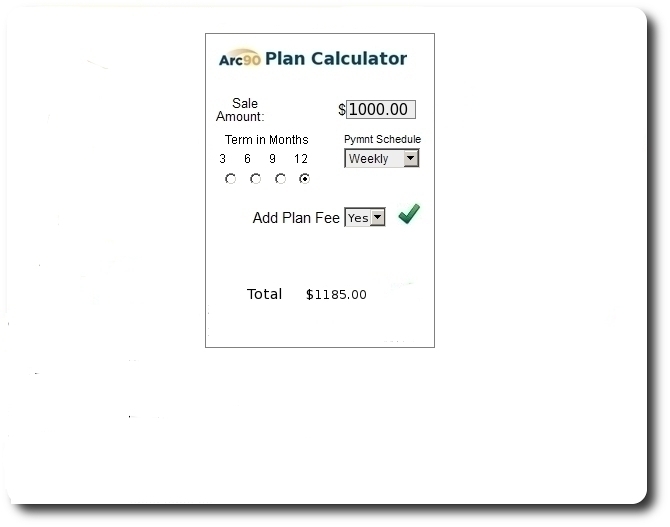

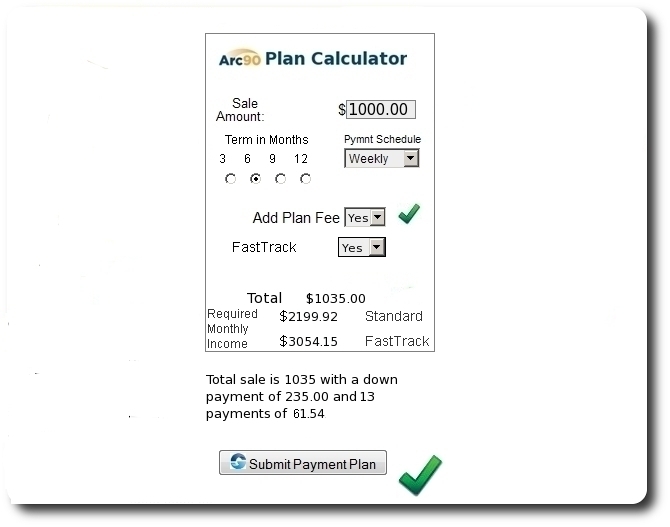

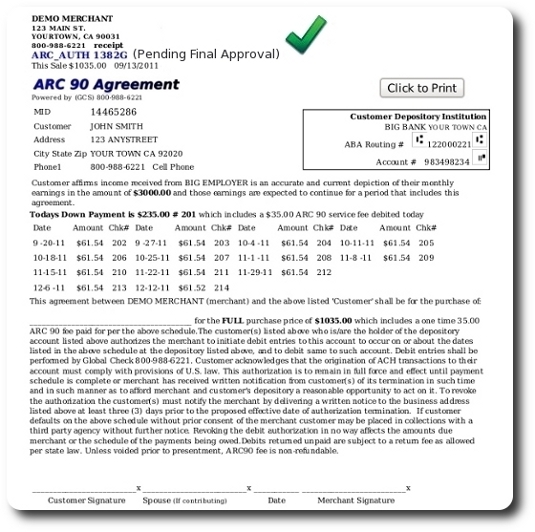

1 The sale must be done correctly using the GCS defined payment plan.

2 The documents for the sale must be accurate and complete.

3 GCS must receive requested documents within the time limits given in the retrieval request.

4 The return reason must be for a covered reason.**

5 The store return rate (bounced items) in dollar value is under 10% *

6 The transaction can not be disputed by the customer.

The following standards apply to maintain a V code status.

1 The sale must be done correctly.

2 The documents for the sale must be accurate and complete.

3 GCS must receive requested documents in order to attempt recovery.

4 The transaction can not be disputed by the customer.

The following standards apply to maintain FastTrack status.

1 All requirements of a G code apply.

2 The sale documents must be faxed/uploaded to GCS on the sale date

3 The down payment debit to the customer must clear. If it bounces sale may revert to V code.

4 The Payment Calculator generated payment plan can not be altered.

* The recovery rate on prior returns may offset this permitting a higher allowed return rate.

** Covered returns are NSF, Closed, Frozen, and Refer to maker.

Others are on a case by case basis.

|

|

Claims Payment

|

On compliant G code items they are paid by not charging back or they are funded on or about the 10th or 25th of the month.

V code transactions are paid once recovered from the customer. Status of recovery on any item is available in the claims section of the merchant record.

|

|